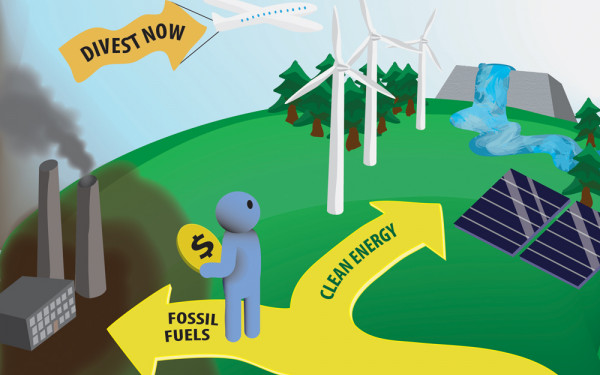

Editorial: Divest Properly, Divest Now

“An ongoing issue with both McGill and Concordia investments is the general lack of transparency.” Sound familiar?

That was from our editorial on fossil fuel divestment last September. Since then, nothing much has changed. The administration is still opaque on much of the process—they set up a $5 million sustainable investment fund, but have not said how much, if any, of that money was taken out of their investment in fossil fuels.

The world, though, has changed. We’re permanently past 400 parts per million of carbon dioxide in the atmosphere—which is not good. As scientists learn to better predict sea level rise—factoring for permafrost-stored greenhouse gases, ice-cap melt acceleration, and more—long-term worst-case scenarios are starting to look like guarantees. And this past year had more record-breaking heat than any period in recorded history.

And it’ll get worse, faster, sooner, if we don’t act better, sooner, faster.

So why is the Concordia University Foundation waiting?

The CUF right now still has roughly ten per cent of its $155 million total investments in fossil fuels—that’s around $15 million dollars invested in advancing climate change, rising seas, resource wars, environmental contamination, and Indigenous rights abuses.

Potentially more disconcerting is that while last year we objected to the lack of transparency in the school’s sustainable investment fund, now it seems the administration still can’t even answer the question of what the $5 million is even invested in.

Bram Freedman, Concordia’s Vice-President of Advancement and External Relations, couldn’t confirm where the university’s dirty investments are because there aren’t any detailed breakdowns of the school’s investments. That makes it difficult to know where to divest from, if the school doesn’t even know what pipeline or gas company it’s profiting from.

Concordia University Fund’s 2009-10 report had specific categories like “oil and gas” and “pipelines” in its investment breakdown. Now, because the Generally Accepted Accounting Principles were changed, those categories have merged to become “energy”—a category vague enough to include wind and solar as well as fracking and tar sands.

Can we, as students, believe that the Concordia administration is divesting from fossil fuels when they haven’t given any indication that the new fund’s funds were taken from Concordia’s oil and gas holdings? The administration made this fund seemingly in response to Divest Concordia’s campaign, but that doesn’t mean it was a divestment.

It’s nice to say that the school is working on being more transparent, and is working with the Joint Sustainable Investment Advisory Committee to reach those goals, but there’s yet to be any action on the matter that can be verified by external sources, like us.

So the lack of transparency is one thing. The lack of expedited action is another, and there really is no excuse for waiting. Issues of climate and sustainability are urgent. Universities should set the example, as centres of thought and progress. The will of the students is for divestment, and respecting that is fundamental. Continuing to invest in oil-stained stacks also tarnishes the school’s public image.

And, perhaps most importantly for those on the fence, divestment isn’t the financial debacle it’s straw-manned up to be by its opponents.

Concordia’s investment in sustainable funds garnered a 3.92 per cent return since October 2015—that’s only 0.39 percentage points less than the Toronto Stock Exchange over the same period, for guaranteed sustainable and ethical investments.

Is it worth undermining the integrity of the university’s investments—let alone the future of our planet—for a difference of $70,000 return on investment over a year?

The Link is in favour of 100 per cent divestment from fossil fuels. We’re so in favour that we want divestment to be done properly, transparently, and as soon as possible. We don’t want to have to rewrite this again next year

_600_832_s.png)

(The_McGill_Daily_600_375_90_s_c1.jpg)