Meet the rich: ConU Board of Governors

An introduction to the people who call the shots at Concordia

Have you ever wondered how decisions are made in such a large institution like Concordia?

The university’s administration consists of the Senate and the Board of Governors, whose members’ tasks include voting on important matters pertaining to all facets of the university. “It has superintending and reforming power over all decisions affecting activities held at the University or connected with the University,” the Board’s website reads.

The Board is composed of 25 voting members and one non-voting member as outlined in the University Charter. While student representation on the board is limited to one member from the Graduate Students’ Association (GSA) and one member from the Concordia Student Union (CSU) (with another serving as an alternate), a majority of members are selected by the Governance and Ethics Committee.

As in many other universities, several members of Concordia’s Board are affiliated with high-profile companies and organizations. Here is a look into a few of the businesses behind its voting members.

Ken Brooks

Senior Vice-President, Ernst & Young

Ernst & Young (EY) is one of the largest professional services firms in the world, specializing in audits, taxes, consulting, and more. Since the Great Recession, the company has been involved in a multitude of scandals concerning its auditing practices, investment banking, and accounting.

In 2008, as the investment banking company Lehman Brothers was collapsing, former U.S. attorney and bankruptcy examiner Anton Valukas accused EY of professional malpractice for failing to disclose the company’s questionable financial practices.

The Wall Street Journal discovered that EY had audited multiple controversial businesses between 2019 and 2020, including the infamous office space company WeWork.

In 2022, the Canadian Public Accountability Board announced it would be investigating EY following the U.S. Securities and Exchange Commission's (SEC) record $100 million settlement with the firm. The SEC penalized EY after 49 audit professionals in the U.S. were found to have cheated on exams for Certified Public Accountant licenses, with hundreds more cheating on professional education courses.

Francis Baillet

Vice-President, Corporate Affairs, Ubisoft

The multi-billion dollar video game company Ubisoft has a long history in Montreal, which is considered one of the top cities worldwide for game development. The company also has a prominent history of sexual harassment cases.

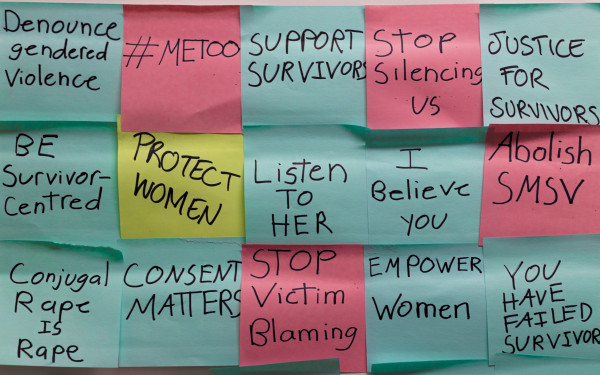

In 2020, a series of sexual misconduct accusations emerged within the video game industry, a continuation of the #MeToo Movement. The allegations included employees at Ubisoft.

The company announced that two executives accused of misconduct were placed on leave, and they initiated an internal review of other accusations and company policies. The co-founder of Ubisoft Toronto resigned due to sexual misconduct allegations, leading to concerns about the studio's handling of complaints.

A workers' rights group, A Better Ubisoft, was formed by employees in August 2021 to seek more commitment and action from the company. The allegations and investigations revealed a widespread problem of sexual misconduct and a toxic work culture within the company, leading to internal changes and employee activism.

Philippe Pourreaux

Vice-President, Valuations, PricewaterhouseCoopers

PricewaterhouseCoopers (PwC) is the second-largest professional services network in the world and part of the Big Four accounting firms, alongside Ernst & Young. The company’s revenue was $50.3 billion USD in 2022.

As was revealed in the Luxembourg Leaks, PwC facilitated hundreds of legal tax rulings for multinational corporations from 2002 to 2010, assuring them a favourable tax treatment. The arrangements saved companies billions in taxes, with some paying less than one per cent on profits.

Rana Ghorayeb

President and CEO, Otéra Capital

Otéra Capital is a Quebec-based company comprised of “experts in commercial real estate debt” and asset management. It is one of the largest institutional fund managers in Canada.

The company was created in 2008 as a subsidiary of the Caisse de dépôt et placement du Québec (CDPQ), specifically geared at commercial real estate lending and debt issuing.

Issues emerged in 2019 when concerns were raised regarding the company’s then-CEO. The CDPQ removed him following an external investigation that revealed serious ethical breaches tied to personal activities.

The investigation was prompted by allegations that a romantic partner of Otéra's vice-president had conducted business with individuals linked to organized crime. Although the investigation found no proof of organized crime infiltration into Otéra, it did uncover ethical lapses by four employees who violated the company’s code of ethics.

This article originally appeared in Volume 44, Issue 1, published September 5, 2023.

_600_375_90_s_c1.jpg)

_600_375_s_c1.png)