Trump wins. What’s at stake for Canada?

Experts say a second Trump presidency could affect jobs and force Canada to up its military spending

Former president Donald Trump is returning to the Oval Office after a decisive victory in the U.S. presidential elections on Nov. 5, making Trump the second president to win two non-consecutive terms.

Experts say that Canada could be in for a sense of déja-vu if his second presidency is anything similar to his first one.

What’s at stake for Canadian workers?

Canada’s trading future with the sleeping elephant down south is precarious under a Trump presidency, according to Mark R. Brawley, professor of international political economy at McGill University.

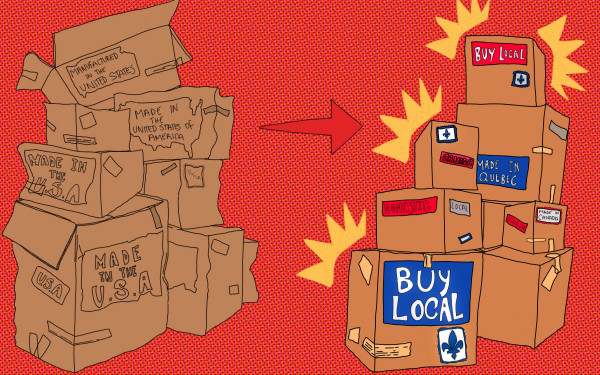

On the campaign trail, Trump has proposed to slap 10 per cent tariffs on all foreign imports. Given Canada’s close trade relationship with the U.S., a tax of that kind could hit many working Canadians hard.

Canada’s economy is heavily reliant on trade, with one in six Canadians working for exporting companies alone. In 2022, Canada sent over 75 per cent of all its exports to the U.S., which was a total of around US$458 billion, according to The World Bank.

“[Tariffs] might be really good for some American manufacturers because they would have zero foreign competition,” Brawley said.

A tariff is a tax on imported goods. But the extra money isn’t paid for by the foreign companies producing those goods, despite Trump claiming that these taxes are "not going to be a cost to [Americans], it’s a cost to another country."

Rather, the American company doing the importing would pay the fees, which would make foreign imports to the U.S. pricier. McGill emeritus professor of American history Leonard Moore said that the past has proven Trump’s claims to be misleading. In 2018, Trump’s tariff policies cost the U.S. up to US$12 billion in bailouts after farmers struggled under tariffs other countries enforced in retaliation.

“The thing that distinguishes Trump and [James David] Vance is that they lie without restraint,” Moore said. “They're like a firehose of lies.”

Trump’s sweeping tariffs would affect workers on both sides of the border. It’s the American consumer who pays for the added tax; and up north, Canadian workers could face cuts as companies struggle to make revenue.

According to Brawley, decreased access to the American market would mean less income for Canadian companies, making Canadian jobs more scarce.

Canada has already witnessed a 1.5 per cent rise in unemployment since the start of 2023, with the rate sitting at 6.5 per cent as of this October. Excluding the pandemic years (2020-21), Trading Economics reports that the rate is now at its highest since the start of 2018.

Possible solutions

One possibility would be for Canada to negotiate an exemption with the U.S., similar to how Australia was exempted from US tariffs on steel and aluminum in 2018.

With US$3.6 billion worth of goods crossing the Canada-U.S. border each day, Canada could make a solid case for an exemption according to Vincent Rigby, Prime Minister Justin Trudeau’s national security advisor from 2020-21.

“Our economies are so interlinked,” Rigby said, “so I think the argument we'd be making to the U.S. is the classic ‘You'll be cutting off your nose despite your face.’”

However, it’s unclear whether Trump would let Canada off the hook that easily, according to Rigby. He said that tariffs could be a useful bargaining chip for Trump to push Ottawa into upping its military budget.

Canada faced criticism from the U.S. this summer for not meeting the minimum North Atlantic Treaty Organization (NATO) requirement of committing 2 per cent of its gross domestic product (GDP) to military spending. At this year’s NATO leaders summit, Trudeau pledged that Canada would meet the spending target by 2032.

“It can get nasty,” Rigby said. “[Trump] could say, ‘How are you doing on that 2 per cent?’ If he doesn't hear what he wants to hear, he may make life difficult for Canada.”

In October, the NATO Parliamentary Budget Officer stated that part of Canada’s projection in reaching the 2 per cent figure by 2032 was “based on an erroneous GDP forecast.”

“There's economic levers he could use, you never know with Trump,” Rigby said. “He's going to drop a surprise on us as a form of punishment for not pulling our weight.”

This article originally appeared in Volume 45, Issue 6, published November 19, 2024.