Divest Now

Why Divestment Is Necessary for Concordia to Flourish

Divestment. It’s the talk of the town, the word on the street. It’s the subject of workshops, the screen print on gym shirts, and the latest petition making the rounds. What’s all the fuss about this newest addition to our vocabulary?

We’ve all heard the word “investment,” which means to place a known amount of money, time or other valuables into a situation, wait and receive greater returns than what you put in.

One can quantify some investments, such as stocks in a company, while other investments, such as time spent with a loved one, enter the realm of the unquantifiable.

Out of all kinds of investments, however, financial investments are perhaps those that can have the greatest impact on our collective well-being. This runs the gamut from the goods we buy, to the services we provide, to the companies we invest in.

Needing large amounts of capital in order to run factories and pay labourers, the vast majority of large corporations are publicly traded. If a publicly traded company makes a profit, investors who own shares of the company may receive a portion of its profits in the form of dividends, provided that the company chooses not to reinvest all of the profits in its own expansion instead.

In addition, if the company is doing well, its shares will likely increase in value on the stock market. These are the financial incentives to invest in profitable industries.

But what does this have to do with Concordia? According to a 2011 financial audit, Concordia University has investments worth over $100 million. And this publicly available audit also indicates that nearly $12 million of that $100 million was invested in various oil, gas and pipeline companies.

It’s understandable why Concordia University invests in fossil fuel companies: As the bedrock of our globalized industrial economy, fossil fuel companies are among the most profitable on the planet.

We use fossil fuels in every aspect of modern life, from the growing of food through personal transportation to the manufacturing of practically everything. Thus the power and influence of fossil fuels companies such as BP, Shell, Exxon Mobil and TransCanada are not to be underestimated. In purely financial terms, investing in fossil fuels is a wise decision.

Now, descending from the abstract realm of neoliberal economic doctrine, let us take a hard look at the reality on the ground. First off, climate change is happening. Every year, the Arctic ice sheet grows smaller in area. Global average temperatures break records set the year before.

On every coastline, the sea level creeps up, centimetre by centimetre. The number of species falls as forests catch fire, deserts claim the grasslands and rivers run dry. This is happening as we speak.

According to the fifth Intergovernmental Panel on Climate Change report, there is a 95 per cent certainty that humans are the cause of most of the global warming observed since the 1950s.

The report lists the burning of fossil fuels as the primary contributor. It adds that tropical deforestation is the second-biggest contributor, as we cut down the forests that render the air breathable on this planet. If we are to preserve the livability of our birthplace, the only home we have, then we must replant the forests and stop burning fossil fuels as quickly as possible.

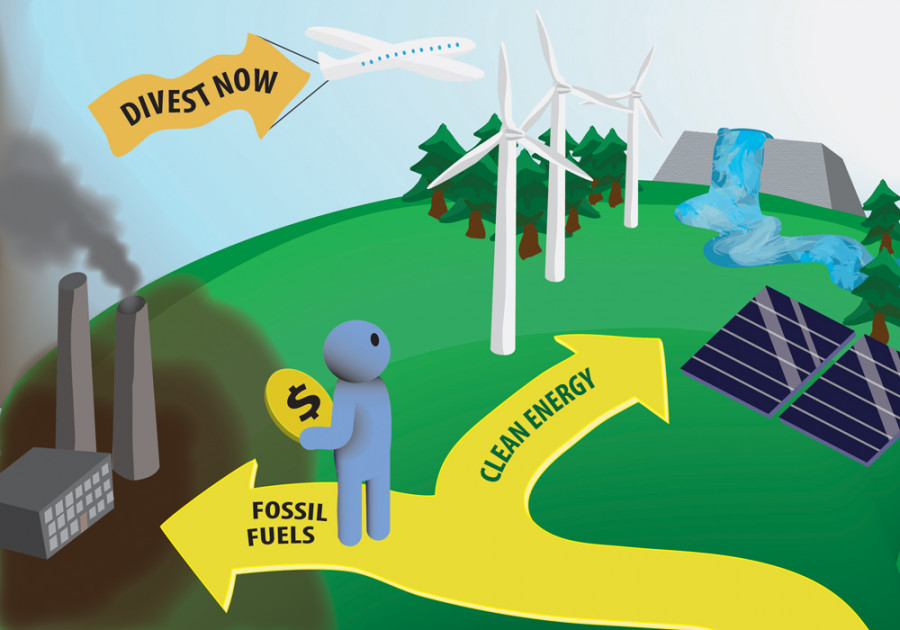

This is where divestment comes in. Divest Concordia, a student-run environmental justice group, is spearheading the campaign to have Concordia University divest—the antithesis to invest—any and all holdings in fossil fuel industries, working to persuade the university’s administration to pull its money out of polluting industries and reinvest in emerging technologies.

Divest Concordia aims to achieve this by convincing the university to form a Committee for Responsible Investment. This committee would oversee the divestment from fossil fuels and reallocation of funds to clean energy companies.

This shift in capital is vital if we are to maintain our modern technologies while developing a low-carbon energy economy.

To me, continued fossil fuel development is an act of madness, plain and simple. To invest in companies perpetrating fossil fuel development is to be an accomplice in a great crime, one that history will judge harshly. Considering the present state of our planet Earth, with climate change already devastating populations around the globe, to divest from fossil fuels is the only logical choice.

Yet even higher than reason, higher than logic, is the love for my family and friends, for the children I hope to have, for all the living beings that share our Earth. We have a moral responsibility to act now, for the gravity of our situation demands nothing less.

That’s why I call on Concordia University to completely divest from fossil fuels by 2015, and to finally invest in a clean future.

(The_McGill_Daily_600_375_90_s_c1.jpg)