JMAS Hosts Free Tax Clinic for Low-Income Individuals

Clinic Completes 400 Tax Returns for Students and Families

On Saturday afternoon, John Molson School of Business classrooms were converted into waiting rooms, where Ika Peraic’s daughter was busy drawing while her mother was passing the time watching Friends reruns, waiting for her family’s tax return to be completed—for free.

While it was the clinic’s fourth year, the student-parent heard about the service for the first time, and found it a good way to save money after a difficult financial year.

Sponsored by the Concordia Student Union, the John Molson Accounting Society free tax clinic was carried out between March 9 and 10, where more than 100 Concordia accounting students, volunteers, and professionals came together to provide a free service to low-income individuals.

“This tax clinic is perfect for students like us, to actually have their taxes done for free,” said Nicole Nadeau, incoming JMAS co-president.

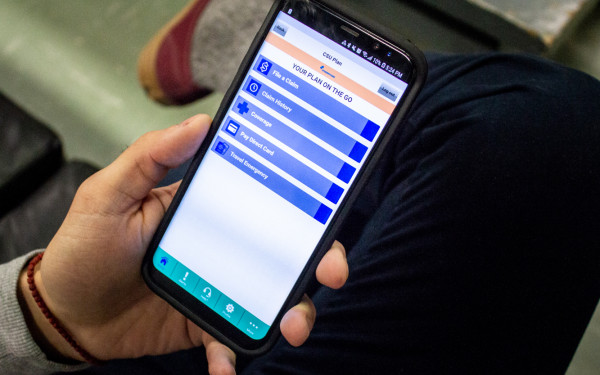

After registration and ensuring eligibility, Concordia accounting students are assigned a client for which they would complete their tax returns. In the span of a few hours, the client would receive their documents ready to be signed and sent to the government, and that have been reviewed by a professional accountant.

Concordia economics student Adewunmi Ajike came to the clinic on Saturday to get her taxes done for the second time.

Ajike said being an international student, she wasn’t as informed about filing her taxes, and along with providing the service, the clinic helped her get a better understanding.

“This is really meant for people who need the help, and that’s where we come in,” said JMAS co-president Marco Rossi. “A tax return of this type would probably be in the ballpark of like $40 or $60, so offering this service for free could be the difference between having groceries for the week or not.”

The tax clinic allows accounting students to go beyond the classroom and get hands-on, valuable experience in their field, explained Rossi.

“We help accounting students be familiar with the kind of tax software that will be used at work,” he said.

After volunteering last year, Nadeau was involved in planning the event this time around. For her, seeing people’s stress melt away for receiving this free service is heartwarming.

Rossi echoed Nadeau’s sentiment—the tax clinic benefits both the community and accounting students.

“To be able to help students develop professionally, and to give them the opportunity to develop a skill set, that’s where the value lies from my perspective,” said Rossi.

Third-year accounting student Ariane Foley’s said her experience exceeded her expectations. Volunteering at the JMAS tax clinic was her first experience dealing with clients, and doing tax returns that weren’t fictional.

“Once the day started, I realized it wasn’t a stressful environment at all,” said Foley. “It was very friendly, all the JMAS team was there to help us if we had any questions. The clients were really nice as well, they were really patient.”

Over the course of the weekend, the tax clinic completed 400 tax returns, with 500 people helped overall. A quarter of the tax returns were for families or couples.

_600_375_90_s_c1.jpg)